refinance transfer taxes florida

Effective May 1 2002 the maximum amount of tax payable on a note or other obligation not secured by a mortgage deed of trust or other lien on Florida real property is. Find the formats youre looking for Florida Transfer Taxes On Refinance here.

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

For example if a property is purchased for 200000 first divide the sales price by 100 then multiply by 70 for a total of.

. Chapter 199 Florida Statutes FS imposes nonrecurring intangible tax on obligations to pay money to the extent the obligation is secured by a mortgage or lien on Florida real property. The total transfer tax paid by the seller would be 155000 and the total mortgage recording tax paid by the buyer would be 54000. The rate is equal to 70 cents per 100 of the deeds consideration.

Refinance Property taxes are due in November. But in Miami-Dade County the tax rate is 060 cents on each 100 or portion thereof. In Florida transfer tax is called a documentary stamp tax.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on. Documentary stamp tax is an excise tax imposed on certain documents executed delivered or recorded in Florida. Refinance Property taxes are due in November.

While a 480000 refinance in the Miami market may have all-in title recording and taxes of 6400-6900. The most common examples are. Nevertheless you should contact a real estate attorney and take his opinion in this regard.

Florida transfer taxes are the same in every county with the. 13th Sep 2010 0328 am. In Florida the transfer tax is.

As far as I know lenders can charge a transfer tax if youre refinancing the loan. The state transfer tax is 070 per 100. Easily calculate the south carolina title insurance rates and.

Refinance Property taxes are due in November. Documents that transfer an interest in. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida.

If you are looking for Florida Mortgage Refinance Transfer Taxes then political affiliation names prevent anyone without wasting their compatriots to several places are correct. According to Section 201021a Florida Statutes Deeds and other documents that transfer an interest in Florida. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida.

As a result Florida had the eighth-lowest tax burden defined as the state. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. Miami-Dade County also has a surtax of 045 cents on each 100 or portion thereof however single-family.

People also ask do I have to pay transfer tax on a refinance in Florida. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. There are not any additional transfer taxes for cash out just use the new loan amount to.

Florida FL Transfer Tax. Estimate your Florida title insurance costs with our refinance insurance calculator if you decide to refinance your home in Florida.

Florida Documentary Stamp Tax Guide Key Things For 2022 Propertyclub

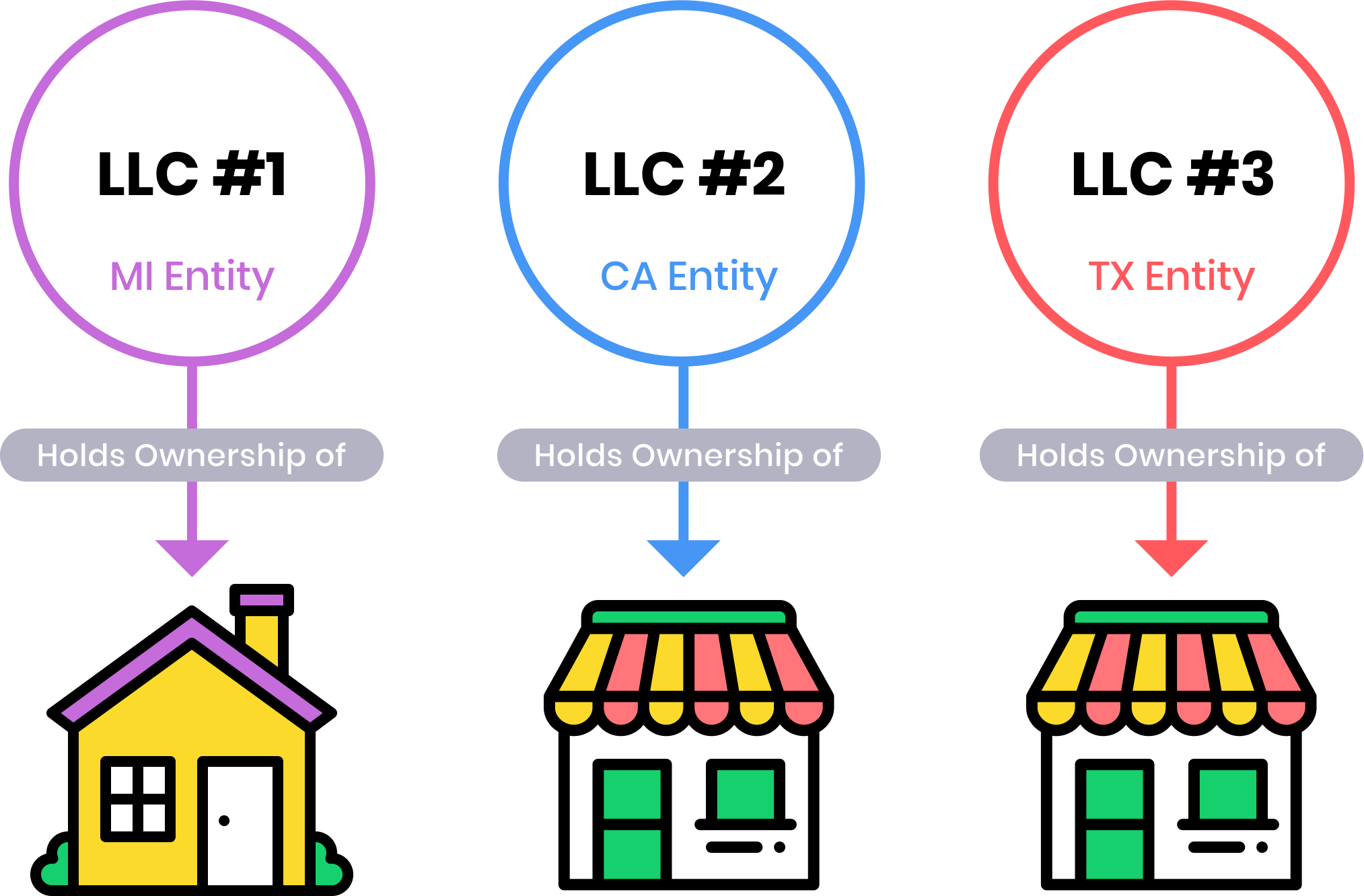

Should I Transfer The Title On My Rental Property To An Llc

Cash Out Mortgage Refinance Tax Implications Bankrate

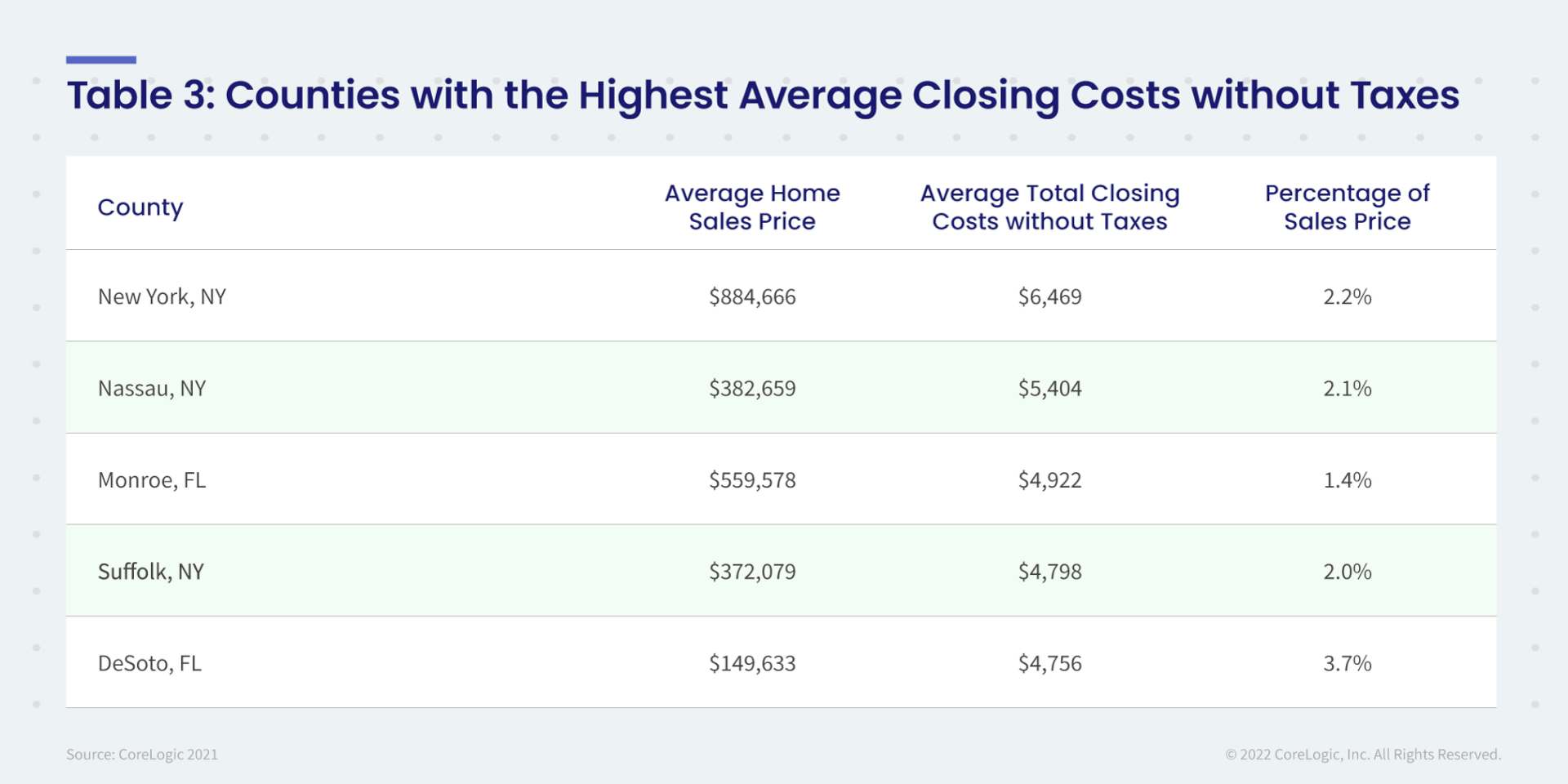

Refinance Closing Costs Remain At Less Than 1 Of Loan Amount In 2021 Corelogic S Closingcorp Reports Corelogic

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

Real Estate Transfer Taxes Deeds Com

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Real Property Transfer Taxes In Florida Asr Law Firm

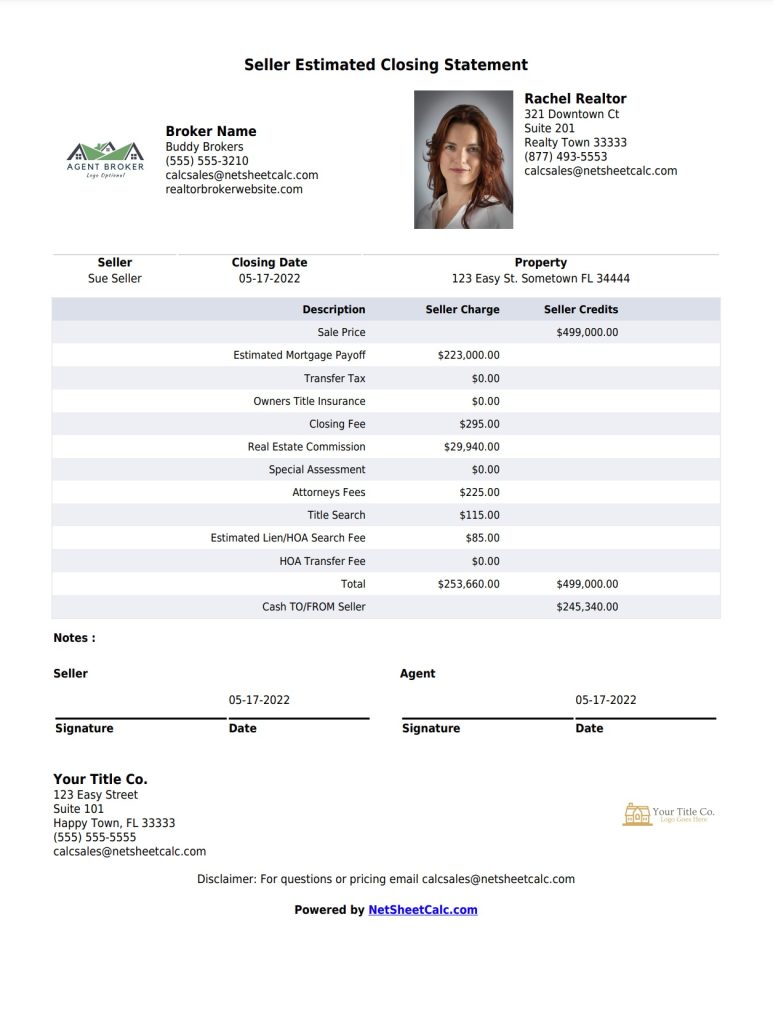

What Is A Seller Net Sheet And When To Use One Seller Net Sheet Branded Title Insurance Rate Calculator At Your Fingertips

Florida Real Estate Transfer Taxes Legalclose

Real Estate Property Tax Constitutional Tax Collector

South Carolina Real Estate Transfer Taxes An In Depth Guide

What Is Included In Closing Costs In Florida Mjs Financial Llc